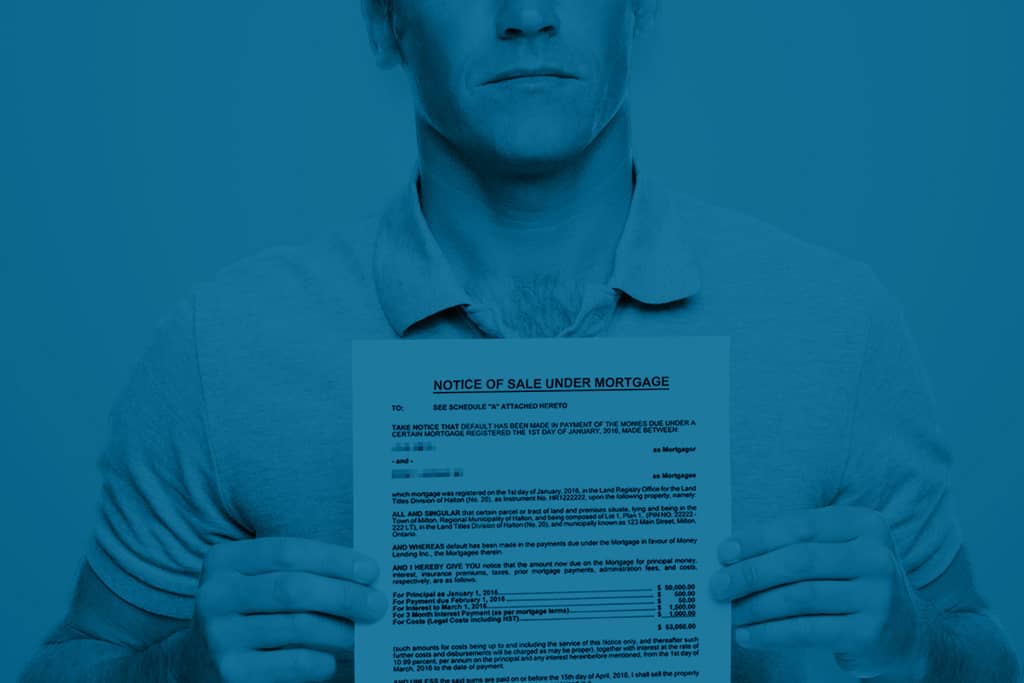

Alternative Lenders Canada – When the Big Banks Say “NO”

Don't let a “NO” hold you back. Discover alternative mortgage lenders in Canada who say 'YES' to your homeownership goal. Get the financing you need with flexibility and personalized solutions.