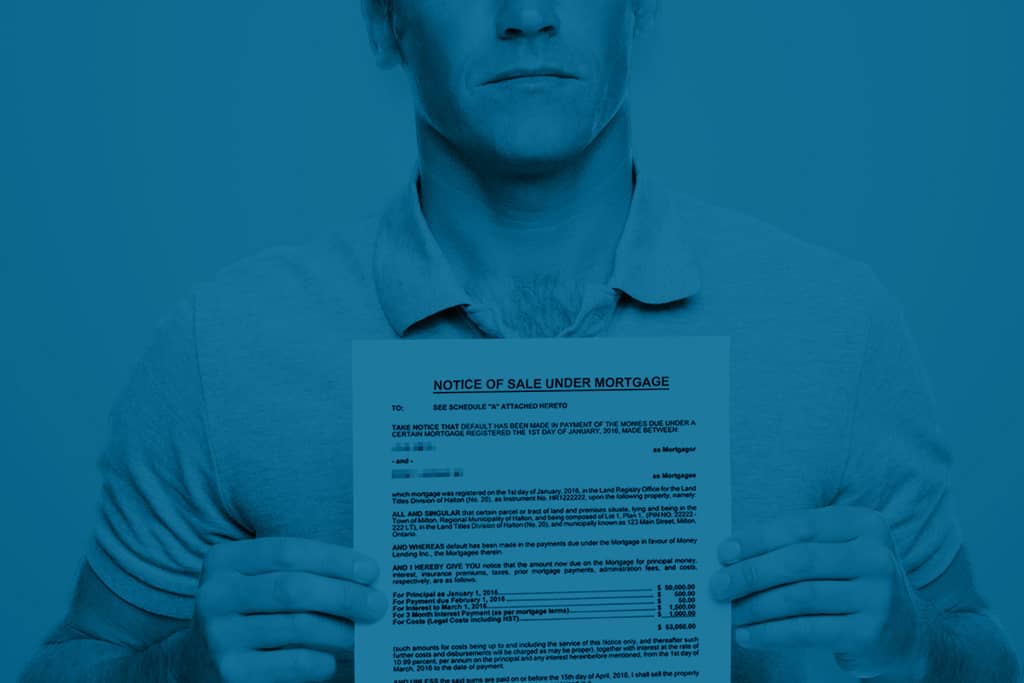

Home Refinance in Canada: How to Refinance Your Mortgage and Get Approved

Whether you’re looking into consolidating debt, renovating your home, or simply reducing your monthly payments, we can guide you through the process. A mortgage refinance in Canada can help you take control of your finances. Get Approved Today!