AI powered mortgages for bad credit are no longer just a concept—they're a real, growing solution for Canadians who don’t meet traditional lending criteria. While these technologies were once limited to A-lenders and prime borrowers, AI is now making serious inroads...

Blog

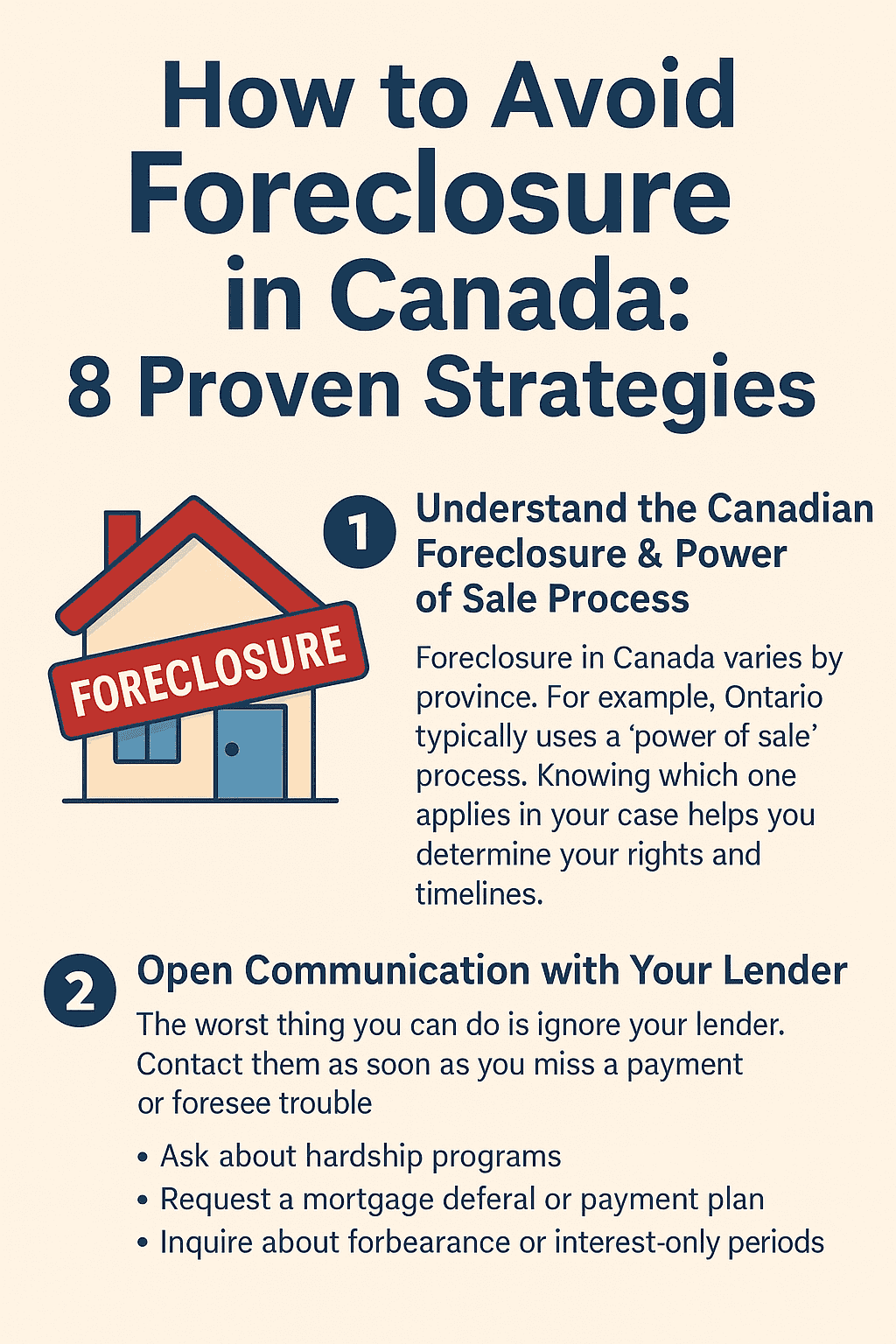

Avoid foreclosure in Canada – Essential Tips for Homeowners

Every year, thousands of Canadian homeowners face the possibility of foreclosure or power of sale due to unexpected financial challenges. While Canada’s national mortgage arrears rate remains below 0.20%, that statistic doesn’t tell the full story for homeowners...

Declined by TD Bank? Don’t Panic You Have Options!

Being declined by TD Bank or any other major financial institution for a mortgage refinance or a home equity line of credit (HELOC) can feel like a setback—especially if you've been a loyal customer. Many homeowners are shocked when their refinancing application or...

Denied by RBC? Here’s How to Rebuild, Refinance, and Return to Your Bank

Being denied by RBC (Royal Bank of Canada) can come as a shock—especially when you’ve built a strong relationship with the bank. Your mortgage, chequing account, and credit cards are all with them, so when it came time to refinance your mortgage or access a home...

Power of Sale: What it is, and how to Avoid it

Power of sale. Three words you never want to hear as a homeowner. Unfortunately, keeping up with your mortgage payment can be a very difficult task. Unexpected expenses like automotive repairs, sudden injuries, or changes in work circumstances can prevent borrowers...

Home Equity Financing: What It Is, How It Works & When to Use It

Home equity financing allows Canadian homeowners to unlock the value in their homes to consolidate debt, cover major expenses, or stop foreclosure. With over $4 trillion in home equity across the country, this guide breaks down how home equity loans, HELOCs, and refinancing work—plus when to use them, how to qualify, and what to watch out for. Learn how to turn your home’s equity into a flexible financial solution.

Behind on Property Taxes? Learn How to Stop a Tax Sale Before It’s Too Late!

Behind on your property taxes in Ontario? Don’t wait for the city to act. Learn how to stop a tax sale, avoid penalties, and use your home equity to regain control—before it’s too late

Missed Mortgage Payments? It’s not too Late!

Missing a mortgage payment can feel overwhelming, but it doesn’t have to lead to foreclosure. Whether it’s due to job loss, illness, or rising living costs, many Canadians fall behind at some point. The key is acting quickly and knowing your options. In this guide, we’ll explain what happens if you miss a mortgage payment in Canada, the impact on your credit, and how to get back on track—before things spiral.

Facing Foreclosure? Here’s How You Can Save Your Home in Ontario

The Reality of Facing Foreclosure in Ontario Imagine this: You’ve been making mortgage payments for years, but due to unexpected financial hardship—job loss, illness, or rising costs—you’ve fallen behind. You receive a Notice of Default from your lender, and suddenly,...

Does Foreclosure Affect Your Credit Score? How to Recover & Rebuild

The Long-Term Impact of Foreclosure on Your Credit Imagine you’ve spent years building your financial future, diligently making mortgage payments. But then, life happens—unexpected job loss, medical emergencies, or rising interest rates—and suddenly, you’ve fallen...

Search

Recent Post

AI Powered Mortgages for Bad Credit: How Canadians Get Approved Faster

AI powered mortgages for bad credit are no longer just a concept—they're a real, growing solution for Canadians who don’t meet traditional lending criteria. While these technologies were once limited to A-lenders and prime borrowers, AI is now making serious inroads...

Avoid foreclosure in Canada – Essential Tips for Homeowners

Every year, thousands of Canadian homeowners face the possibility of foreclosure or power of sale due to unexpected financial challenges. While Canada’s national mortgage arrears rate remains below 0.20%, that statistic doesn’t tell the full story for homeowners...

Declined by TD Bank? Don’t Panic You Have Options!

Being declined by TD Bank or any other major financial institution for a mortgage refinance or a home equity line of credit (HELOC) can feel like a setback—especially if you've been a loyal customer. Many homeowners are shocked when their refinancing application or...