Are you feeling overwhelmed by property tax bills? You’re not alone. Many homeowners in Canada find themselves in a tough spot when it comes to paying property taxes. But don’t worry, there’s a solution! Home equity financing could be your lifesaver. Let’s dive into how you can tackle property tax challenges head-on.

What Happens If You Can’t Pay Property Tax in Canada?

Property taxes are a fact of life for homeowners in Canada. These taxes fund essential services like schools, roads, and emergency services. But what if you find yourself unable to pay? This situation can be stressful, but it’s important to know the consequences and available solutions.

If property taxes aren’t paid on time, the local government may impose late fees and interest. In the long term, continued non-payment can lead to more serious consequences, such as a lien against your property. This means the government has a legal claim to your property due to unpaid debts. To avoid these scenarios, it’s crucial to seek solutions early.

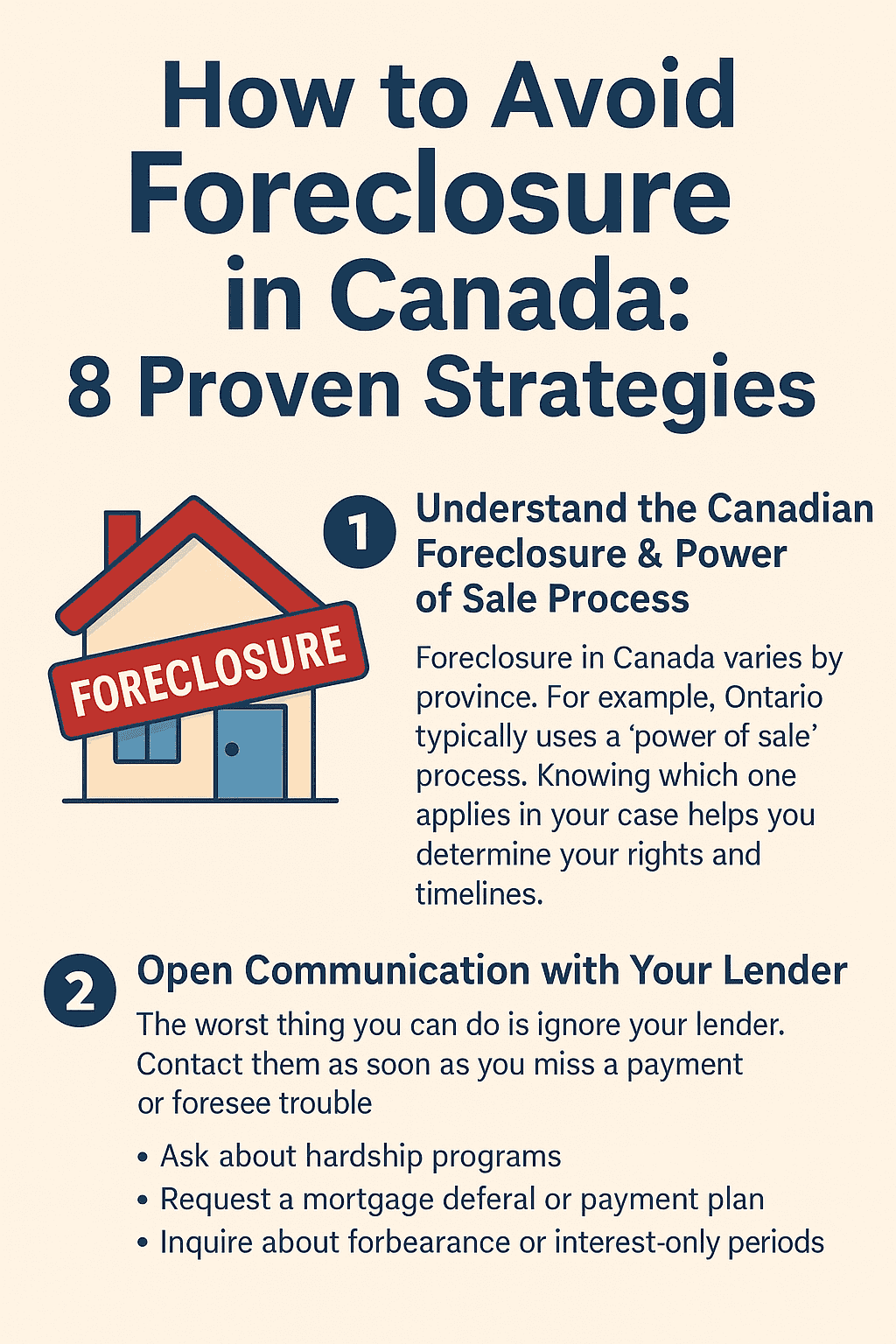

How Long Can You Go Without Paying Property Taxes in Ontario?

In Ontario, the timeline for unpaid property taxes is quite strict. After missing a payment, you’ll face immediate penalties and interest. If taxes remain unpaid for a certain period, usually two years, the municipality may start the process to sell your property to recover the owed taxes.

This might sound scary, but remember, there are ways to manage this situation. Which brings us to a solution many Canadians are turning to – home equity financing.

Understanding Home Equity Financing

Home equity financing involves borrowing money against the value of your home. Think of your home as a financial asset. Over time, as you pay off your mortgage and your property’s value increases, you build equity. This equity is the difference between your home’s value and the outstanding mortgage amount.

Home equity financing can come in different forms, such as a Home Equity Line of Credit (HELOC) or a second mortgage. These options can provide you with the funds needed to pay off your property taxes.

Why Choose Home Equity Financing for Property Tax Payments?

- Quick Access to Funds: Home equity financing can offer a fast solution to settle outstanding property taxes, preventing late fees and legal issues.

- Lower Interest Rates: Generally, loans secured against home equity have lower interest rates compared to unsecured loans or credit cards.

- Flexible Repayment Plans: These loans often come with flexible repayment options, making it easier to manage your finances.

The Process of Applying for Home Equity Financing

Applying for home equity financing is a straightforward process, especially with the help of experts like those at TurnedAway.ca. Here’s a simple outline:

- Assess Your Equity: Determine how much equity you have in your home. This can be done by using a home equity calculator.

- Choose the Right Product: Decide whether a HELOC or home equity loan best suits your needs.

- Application: Complete an application, providing necessary financial details.

- Approval and Access to Funds: Once approved, you can use the funds to pay off your property tax bill.

The Role of TurnedAway.ca in Resolving Your Tax Challenges

TurnedAway.ca specializes in helping homeowners like you access home equity financing, even in challenging situations. If traditional lenders have turned you away, TurnedAway.ca can offer alternative solutions. With their expertise and understanding of the Canadian real estate market, they can guide you through the process, ensuring you make the best decision for your financial situation.

Managing Your Finances Post-Home Equity Financing

After resolving your immediate tax concerns, it’s essential to manage your finances to prevent future issues. Consider the following tips:

- Create a Budget: Track your income and expenses. Prioritize property tax payments to avoid future problems.

- Plan for Property Tax Payments: Set aside funds regularly to cover your property taxes.

- Consult Financial Experts: Advisors at TurnedAway.ca can offer insights into managing your home equity loan and overall financial health.

Property tax challenges can be daunting, but with the right strategy, they’re manageable. Home equity financing offers a practical solution to clear your tax dues and avoid legal troubles. TurnedAway.ca is your partner in navigating these financial hurdles, offering tailored advice and solutions.

Remember, taking proactive steps today can secure your financial stability tomorrow. Don’t let property tax challenges overwhelm you – explore your options and take control of your financial future.

Ready to resolve your property tax issues with home equity financing? Contact the experts at TurnedAway.ca today and take the first step towards financial peace of mind! Apply Online or contact us at 1-855-668-3074 to get back on track financially.