“Many Canadians are ready to spend big when interest rates drop—are you prepared to make the most of it?”

Dropping interest rates can change everything. For homeowners, buyers, or anyone managing debt, when rates drop, it can feel like a financial windfall. According to a recent survey, many Canadians are prepared to spend more when interest rates fall, but that doesn’t necessarily mean just splurging. It’s about strategic spending, saving, and refinancing to improve financial health and future stability. Let’s dig into what dropping interest rates mean for you and how to make the most of it.

How Dropping Interest Rates Affect Spending and Savings

Dropping Interest rates directly affect the cost of borrowing. When they fall, loans, mortgages, and credit often become more affordable, freeing up cash flow. For many Canadians, this means a boost in purchasing power. But how should you take advantage of lower rates without overextending yourself?

More Spending Power but Spend Wisely

As borrowing becomes cheaper, it might be tempting to make large purchases, like a new car, home renovations, or that dream vacation. While this could be the right move for many, it’s essential to prioritize where your money will have the most significant impact. If you’re a homeowner, you might consider investing in your property or consolidating high-interest debt to strengthen your financial position.

Increased Savings Opportunities

Dropping interest rates often mean lower monthly payments for mortgages and loans. The extra money saved can be redirected toward building an emergency fund, investing, or paying down existing debt faster. Think of this as a chance to reallocate those savings in a way that supports your future financial goals.

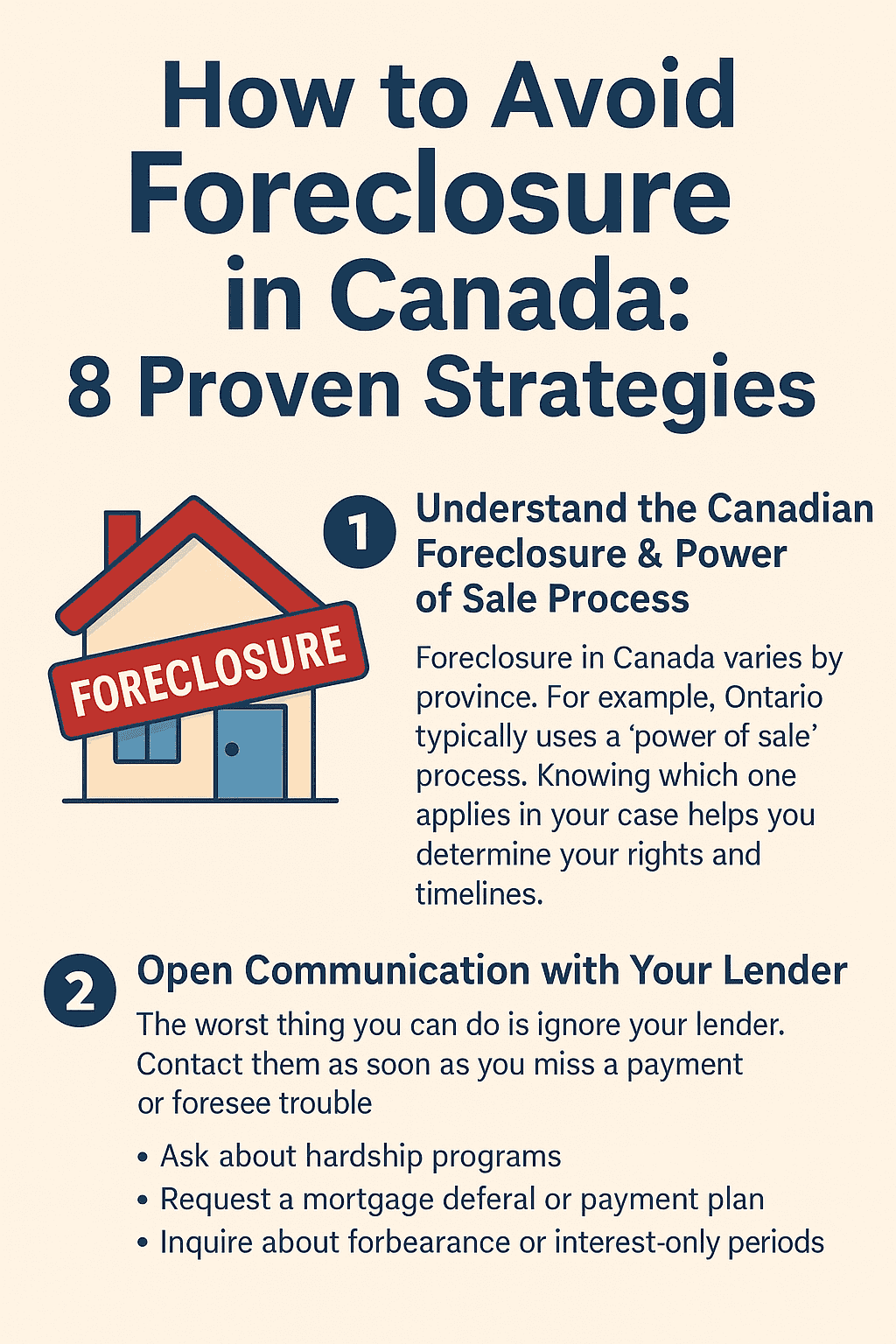

Refinancing Your Mortgage: How to Make It Work for You

One of the biggest opportunities when interest rates drop is refinancing your mortgage. Refinancing means replacing your existing mortgage with a new one, ideally at a lower interest rate, which can reduce your payments and free up cash.

Why Refinance?

Refinancing can help you:

- Lower Your Monthly Payments: A reduced interest rate means a lower monthly payment, which can ease financial stress or provide extra cash for other expenses.

- Access Your Home Equity: Refinancing can allow you to tap into your home equity for renovations, debt consolidation, or investments.

- Switch to Better Terms: If you initially took on a mortgage with less favorable terms (e.g., a higher interest rate due to bad credit), refinancing in a lower rate environment can significantly improve your mortgage terms.

Example Case Study

Consider Mark, a homeowner in Calgary. When he purchased his home, interest rates were higher, leading to a steep monthly payment. When rates fell, Mark refinanced his mortgage through Turnedaway.ca, securing a lower interest rate and freeing up $400 a month. He used those savings to pay down credit card debt and build an emergency fund, putting himself on stronger financial footing.

Flexible Mortgage Solutions for Canadians

For homeowners with less-than-perfect credit or those experiencing financial challenges, a drop in interest rates presents a golden opportunity. Many traditional lenders may have stringent criteria, but that doesn’t mean refinancing is off the table.

Home Equity Loans and HELOCs

A Home Equity Loan or a Home Equity Line of Credit (HELOC) allows you to borrow against the value of your home. With interest rates low, this can be an affordable way to access funds for debt consolidation, home improvements, or other financial goals. Even if your credit isn’t perfect, the equity in your home can provide a gateway to financing options that work for you. Learn more about leveraging your property’s value by visiting our home equity loans page.

Debt Consolidation to Reduce High-Interest Debt

If you’re carrying high-interest debt, like credit cards or personal loans, consolidating that debt into one lower-interest loan can make it much more manageable. Not only can you reduce your monthly payments, but you can also pay off the principal faster. Turnedaway.ca specializes in helping Canadians consolidate their debts, creating an efficient payment plan that can help improve your financial health. Visit our debt consolidation page to explore how you can benefit.

Maximize Savings Through Refinancing

Refinancing isn’t just about reducing your mortgage payment; it’s also a way to save money over the long term. By locking in a lower rate, you may be able to shorten your mortgage term without significantly changing your monthly payment, allowing you to pay off your home faster and save on overall interest costs. Explore our mortgage refinancing solutions to see how we can help you make the most of your savings.

Choosing the Right Mortgage Rate: Fixed or Variable?

When interest rates drop, the decision between fixed and variable rates becomes more important than ever. Here’s how you can make the right choice for your financial needs:

Fixed-Rate Mortgages: Stability and Predictability

A fixed-rate mortgage offers a consistent payment over the entire term of the mortgage. If you’re looking for stability and want to know exactly what you’ll pay month to month, locking in a low fixed rate can provide peace of mind. This is a solid choice if you plan to stay in your home long-term or don’t want to deal with potential fluctuations.

Variable-Rate Mortgages: Flexibility with Market Movement

Variable rates tend to start lower than fixed rates and fluctuate based on market conditions. When interest rates are low, you may benefit from lower monthly payments, but there’s always a chance that rates could rise again, increasing your costs. If you’re comfortable with some uncertainty and want to capitalize on lower initial payments, a variable rate could be a great fit.

Making the Decision

Ultimately, choosing between fixed and variable rates depends on your financial goals, tolerance for risk, and market expectations. If you’re unsure which option works best for your situation, check out our flexible mortgage solutions to find the right fit for your financial needs.

FAQs on Dropping Interest Rates

Should I spend more when interest rates drop?

Lower rates make borrowing more affordable, but spending should align with your long-term financial goals. It can be a great time to refinance, consolidate debt, or invest in value-adding purchases like home renovations. Always make sure your spending is planned and beneficial to your financial future.

Is refinancing a good idea when interest rates drop?

Yes, refinancing can reduce your interest payments, lower your monthly mortgage payment, or help you access your home equity. It’s often a smart move when rates drop, but it’s crucial to evaluate your current mortgage, financial goals, and future plans before refinancing.

How can I use my home equity when rates are low?

Accessing home equity through a loan or line of credit can provide funds for debt consolidation, home improvements, or even investments. A low-interest rate environment makes borrowing more affordable, so it’s a great time to explore your options.

Can I still refinance or consolidate debt if I have bad credit?

Yes. At Turnedaway.ca, we focus on your home equity and financial situation rather than just your credit score. Our goal is to provide solutions that help you improve your financial health, regardless of your credit history.

Final Thoughts: Seizing Opportunities in a Dropping Interest Rates Environment

Dropping interest rates offer a chance to improve your financial situation—whether through saving, spending strategically, or refinancing. It’s about making informed decisions and using this period to benefit your financial future. Turnedaway.ca is here to help you explore flexible mortgage solutions, refinance your mortgage, or consolidate debt to enhance your financial well-being.

Ready to take advantage of dropping interest rates? Apply Online today or Schedule a Free Consultation with a Turnedaway.ca specialist to explore your options. Let’s work together to make your finances stronger and your future brighter.